What we do

pinBox is a global social pensionTech committed to digital micro-pension inclusion in Asia, Africa and Latin America

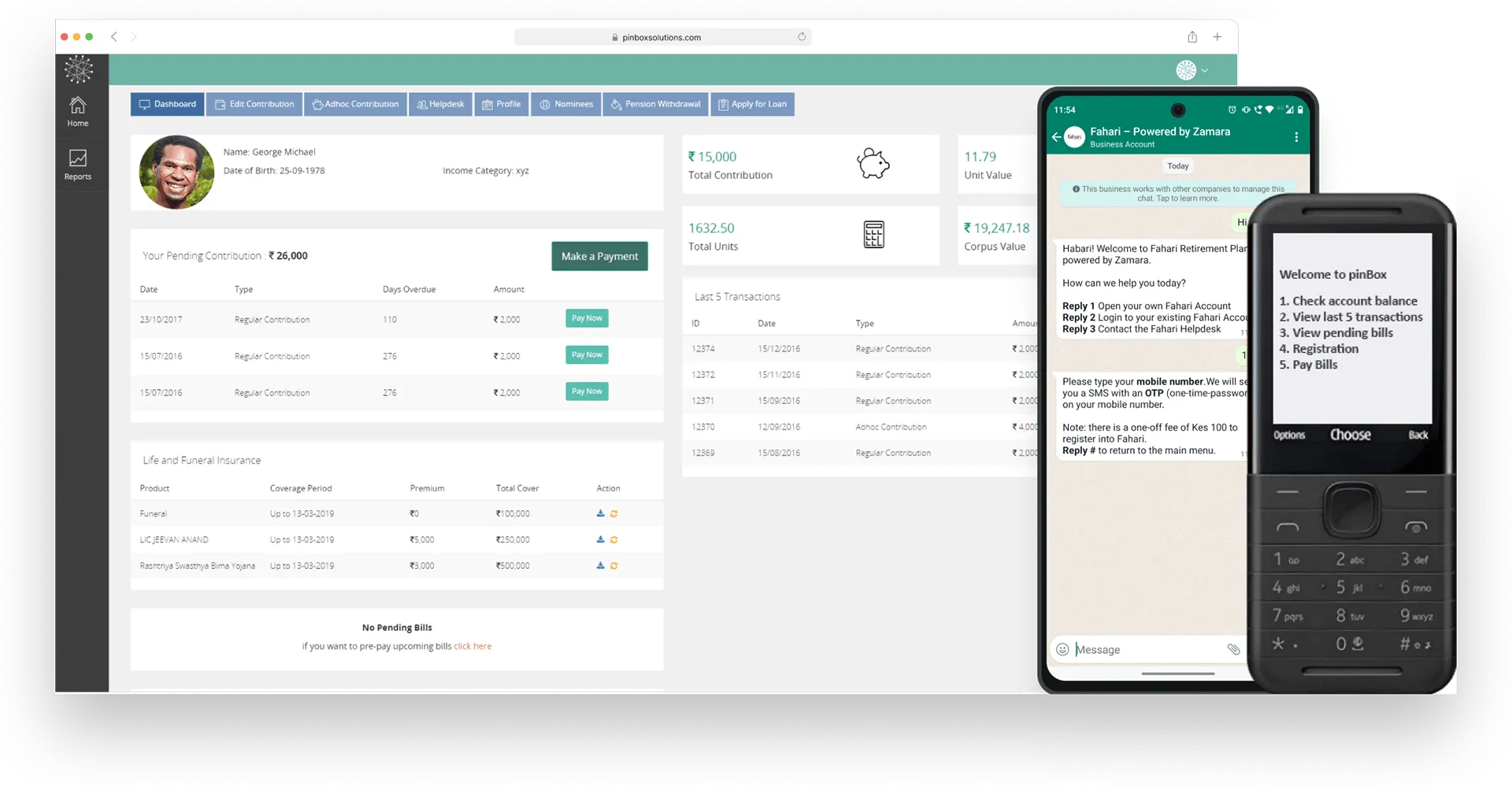

OTC pensionTech

Specialized, white-labelled and API enabled enterprise micro-pension, savings and insurance administration and delivery platform. Can be customized within a few months. For any country.

Pension marketplace

We leverage the existing digital finance ecosystem to help ‘switch-on’ an omni-channel, multi-product digital ‘marketplace’. On a variable cost basis.

Expert assistance

We help design products, processes, governance frameworks and voluntary coverage expansion and persistency strategies. And provide our field-tested retirement literacy and training toolkits.

Advocacy

We undertake research, publishing and events to foster cooperative and collaborative stakeholder actions for more comprehensive pension, savings and insurance inclusion.

THE MULTI-TRILLION DOLLAR PROBLEM AND OPPORTUNITY

80%

Percentage of the workforce across Asia, Africa and the LAC that is excluded from formal pension arrangements and thus not preparing for retirement

1.7 billion

Population of the elderly in developing countries by 2050 who will not have a pension and will face extreme old age poverty for over 2 decades

$11 trillion

Fiscal cost of a tax funded social pension of even US$1 a day to the future elderly

$600 p.m.

Inflation indexed monthly pension (at 2019 prices) that a 20-year-old could achieve starting age 60 by saving $1 a day in real terms

$1.4 trillion

Value of new long-term savings within a decade if even 10% of the excluded young workers in Asia, Africa and the LAC begin saving $1 a day for old age

pinBox pensionTech Platform

White Labelled

Specialized, white-labelled micro-pension and insurance administration, record-keeping and digital delivery platform.

Ready to deploy

Uses secure APIs to integrate the existing digital finance ecosystem. Helps “switch-on” a national digital micro-pension marketplace for non-salaried individuals. Within a few weeks.

Fully Customizable

Easily customizable for voluntary micro-pensions for the self-employed. Also for administering mandatory pension and PF schemes for salaried workers. In any jurisdiction.

Low Start-up Costs

Helps governments, pension funds and insurers avoid high capital costs, lead-time and risks (of mistakes in design) in building proprietary pensionTech from scratch.

Secure and Scalable

ISO 27001: 2013 and ISO 9001:2015 certified platform based on a micro-services architecture. Automated, real-time accounting, reconciliation and allocation of contributions. Zero risk of errors or fraud.

High Governance Standards

Real-time MIS and reports to monitor efforts and outcomes. Automated process, TAT and SLA compliance monitoring through real-time exception reports.

Adoption of the pinBox digital micro-pension model

Rwanda | 2019

First country in Africa to adopt the pinBox model. By 2022, the Ejo Heza program had 2.4m voluntary subscribers, half of whom are women. RwF 50 billion in new long-term savings mobilized since 2019.

Kenya | 2020

pinBox pensionTech deployed with Zamara and Prudential for an integrated pension and insurance solution for Kenya's 17m informal workers.

India | 2021

Five non-linear digital delivery platforms built and field-tested for India. Product partnerships with leading financial institutions. As also with highly trusted and committed outreach partners to jointly deliver micro-pensions to their over 20m clients.

Partners we work with

Insurers and AMCs looking to build a new mass-market for pensions and insurance among LMI segments.

Governments and regulators looking to expand voluntary pension coverage to excluded non-salaried workers.

Pension administrators looking to migrate from legacy tech to a more modern, agile, low-cost and user-friendly pension admin platform. And extend formal pension benefits to informal workers

Aggregators (banks, gig platforms, MOs, fintechs) looking to increase their services portfolio, earn new fee income and build long-term client connect and loyalty.