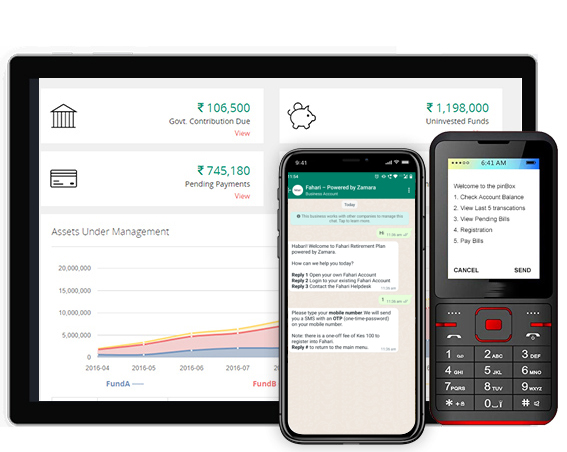

pinBox pensionTech platform

Short Time-to-Market

White-Labelled

Specialised, white-labelled micro-pension administration, record-keeping and delivery platform.

Ready-to-Deploy

Uses secure APIs to integrate the existing financial inclusion ecosystem. Ecosystem partners do not need to invest in new capacity to provide micro-pension services.

Fully Customisable

Can be easily customised for any country within a few weeks.

Low Start-up and Operating Costs

Low Capital Costs

Helps pension funds, insurers, administrators and aggregators avoid high capital costs, lead-time and risks (of mistakes in design) with building a proprietary pensionTech platform from scratch.

Low Operating Costs

Ecosystem partners do not need to invest in new capacity to provide micro-pension services. They operate on a variable cost basis and become instantly profitable. Even with modest fees and charges.

Demand Aggregation

Governments, pension funds and insurers do not face millions of small value transactions. They only deal with wholesale assets and aggregated premiums.

Secure and Scalable Architecture

CONVENIENT, UNIVERSAL ACCESS

Uses secure APIs to integrate well the regulated digital financial inclusion ecosystem to help "switch-on" a universally accessible digital micro-pension marketplace.

OPEN-PENSION APIs

Gig-economy aggregators, MNOs and fintech firms can embed the pensionTech platform onto their own applications. And deliver a secure micro-pension solution to their clients, employees or service partners with minimal effort and domain knowledge.

PLUG-AND-PLAY FACILITY FOR TRADITIONAL AGGREGATORS

Banks, MFIs and cooperatives can use a web or mobile application to access the pinBox pensionTech platform. And instantly offer a regulated pension and insurance solution to their clients or members.

Effective Client Protection

Automated reconciliation

Automated, real-time accounting and reconciliation of micro-pension and microinsurance contributions. Zero risks of errors or fraud.

Real-time compliance monitoring

Real-time MIS and reports to monitor efforts and outcomes. Automated process, TAT and SLA compliance monitoring through real-time exception reports.

Effective complaints resolution

Easy filing and automated reporting, escalation, tracking, and resolution of complaints. Fully automated process architecture to prevent mis-selling.

Easy and Convenient Single-Window Access

Portable Individual Accounts

Unique, national ID-linked micro-pension account stays with a member through changes in jobs or locations over time. Retirees and nominees face zero challenges in proving ownership of benefits.

SIMPLE, INTUITIVE INTERFACE

Citizens are free to use WhatsApp, USSD or a web platform to set up a micro-pension account within minutes.

Single-Window Access

Single-window access to a uniformly high-quality service. Simple USSD interface for citizens with feature phones. And for those based in remote rural locations with low bandwidth.

High Voluntary Enrolments and Persistency

Direct Delivery of Fiscal Incentives

Unique, NID-linked accounts enable direct and seamless delivery of fiscal incentives without any risk of leakages or errors.

Multi-Products

Citizens enjoy an attractive, integrated product solution that delivers both high real returns on long-term savings and covers the cost of short-term lifecycle risks.

Behavioural Interventions

Automated payment receipts, reminders, nudges and other behavioural interventions to prompt regular and optimum contributions. Anytime access to account balance information and statements.

Adaptable to Pensions for Salaried Workers

Easy Bulk Enrolments

Smaller employers including MSMEs can open and operate bulk pension and insurance accounts for their salaried employees.

SIMPLE PLUG-AND-PLAY SOLUTION FOR MASTER-TRUSTS

Citizens are free to use WhatsApp, USSD or a web platform to set up a micro-pension account within minutes.

Adaptable to Occupational Plans

Public and private pension administrators can migrate occupational pension plans to the pinBox pensionTech platform. This will lower administration and servicing costs, and enhance governance, compliance, efficacy and client confidence.