Publishing

Overview of The Book

(English)

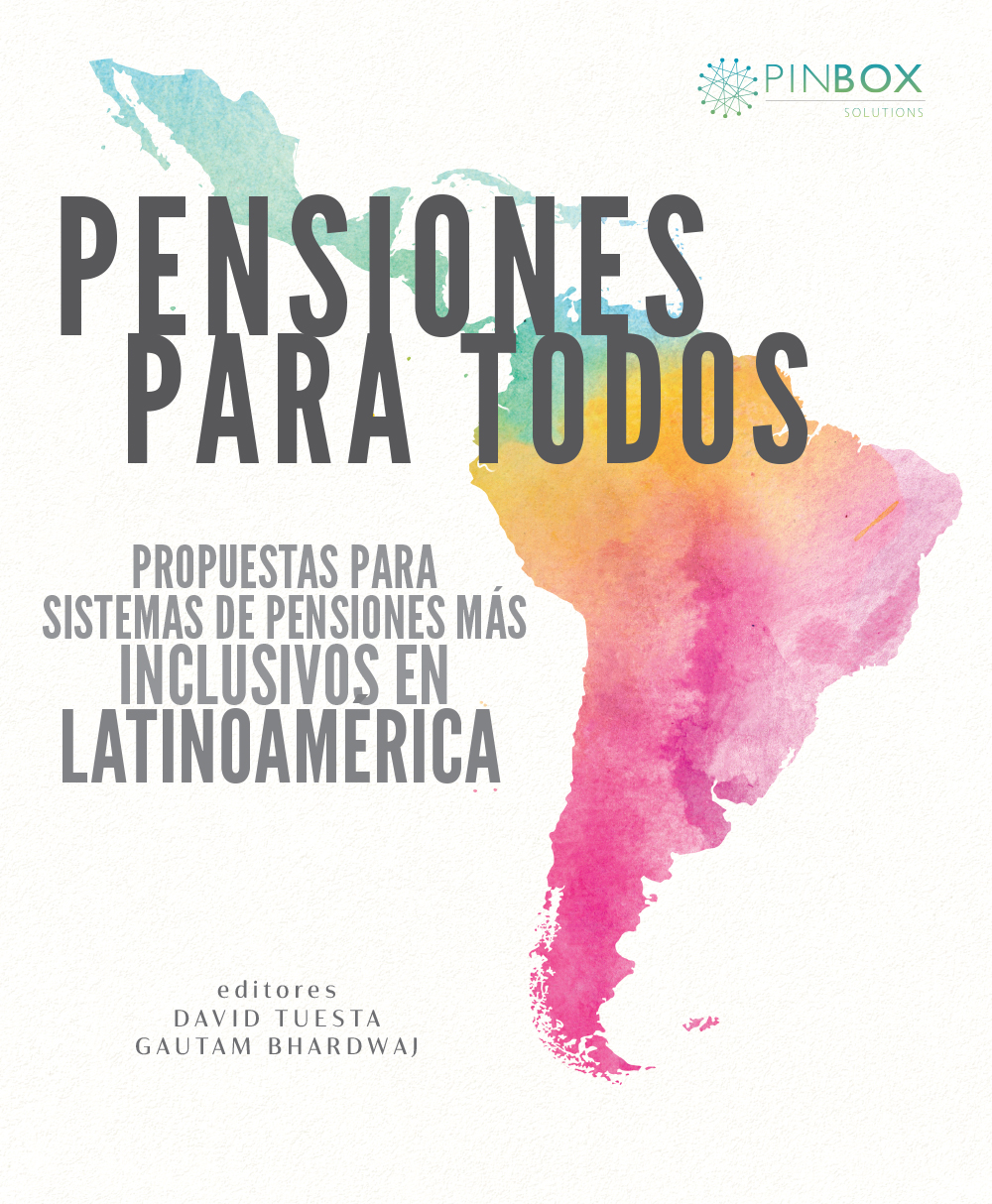

One of the pending tasks in Latin America is the development of a pension system that is widely accessible, sufficient and financially sustainable over time. Beyond the different degrees of progress in each of the countries, they all face similar internal and global challenges. In particular, the problems of high informality of institutions and labor markets make the road even more uphill.

The recent Covid19 pandemic scenario has highlighted the structural weaknesses of pension systems in the region, thus exacerbating several transformations that were already unfolding. While internally, the main challenges already rested on the consolidation of the necessary economic stability and the development of consensus among economic and social agents, externally, a series of global trends such as demographic, financial, labor, technological and environmental ones were being observed.

All of the above raises the need for policy makers in Latin America to develop approaches aimed at innovating their respective retirement systems where, for example, some tools that are being developed in the regulatory, digital and behavioral economics fields are showing increasing evidence that they can support public policies in a more generalized way, helping to build a more sustainable profile for pension systems.

Given this scenario, different pension experts have been brought together to develop the book "Innovating pensions for the self-employed and informal workers in Latin America", edited by pinBoxSolutions. This volume aims to propose innovative solutions to the main problems on the supply and demand side that have been limiting the possibility of building greater pension savings, particularly in the informal population segments. To this end, the analysis, diagnoses, regulatory initiatives and innovative experiences that contribute to improving pension systems will be brought together. This will make it possible to build a set of concrete recommendations for Latin American policy makers.

(Español)

Una de las tareas pendientes en Latinoamérica se centra en el desarrollo de un sistema de pensiones que sea de acceso amplio, suficiente y financieramente sostenible en el tiempo. Más allá de los diferentes grados de avance en el que se encuentran cada uno de los países, todos enfrentan similares retos internos y globales. En particular, los problemas de elevada informalidad de las instituciones y de sus mercados laborales, hace el camino aun más cuesta arriba.

El reciente escenario de pandemia del Covid19 ha puesto de manifiesto en la región las debilidades estructurales de los sistemas de pensiones, agudizando así varias transformaciones que ya se venía desplegando. Mientras internamente, los principales retos ya descansaban en la consolidación de la necesaria estabilidad económica y el desarrollo de consensos entre los agentes

económicos y sociales, en el ámbito externo se venían observando una serie de tendencias globales tales como las demográficas, financieras, laborales, tecnológicas y medio ambientales.

Todo lo anterior plantea a los hacedores de política en Latinoamérica la necesidad de desarrollar aproximaciones dirigidas a innovar sus respectivos sistemas para la jubilación donde, por ejemplo, algunas herramientas que se vienen desarrollando en el ámbito regulatorio, digital y la economía del comportamiento, muestran cada vez mayor evidencia que pueden dar soporte de forma más generalizada a las políticas públicas ayudando a ir construyendo un perfil más sostenible a los sistemas pensionarios.

Dado este escenario, es que diferentes expertos en pensiones han sido reunidos para desarrollar el libro "Innovating pensions for the self-employed and informal workers in Latin America”, editado por pinBoxSolutions. Este volumen tiene como objetivo proponer soluciones innovadoras a los principales problemas desde el lado de la oferta y la demanda que vienen limitando la posibilidad de construir un mayor ahorro pensionario, en particular en los segmentos poblacionales en el mundo informal. Para ello se reunirá el análisis, diagnósticos, inciativas regulatorias y experiencias innovadoras que contribuyan a mejorar los sistemas de pensiones. Con ello se podrá construir un conjunto de recomendaciones concretas para los hacedores de política latinoamericanos.

Editors

CONTENTS

Pensions for all proposals for inclusive pensions in Latin America

(Version 02.02.2023)

-

President of the Private Competitiveness Council - Perú

Director and Global Head Fintech, pinBox Solutions

Part One

Chapter 1

- Building pensions in Latin America and potential viable solutions President of the Private Competitiveness Council - Perú

Part Two

Chapter 2

- How to design a pension system in the face of the challenge of labor informality? Chief, Labor Markets and Social Security Division at the Inter-American Development Bank Consultant at the Labor Markets and Social Security Division Lead Labor Market Specialist at Inter-American Development Bank Senior Specialist of the Labor Markets and Social Security Division, Inter-American Development Bank at IDB

Chapter 3

- Pension reform: changing the narrative Lead Economist at The World Bank Senior Consulting, World Bank

Chapter 4

- Reinventing pension systems in Latin America Head of Latin America and the Caribbean Unit at the OECD Development Centre

Chapter 5

- Savings and pensions in the informal sectors: evidence from Latin America Senior Specialist, Financial Inclusion, CAF

Part Three

Chapter 6

- Can pension coverage of the self-employed in Latin America be improved? Professor, Universidad del Pacifico Research Assitant, Universidad del Pacifico

Chapter 7

- Pension systems for self-employed or informal workers. The case of Argentina Director of the Social Protection Program at CIPPEC

Chapter 8

- Public and Private Pension Solutions for self-employed Workers in Brazil General Coordinator of Technical Studies and Conjunctural Analysis at the Subsecretariat of Complementary Social Security Federal civil servant - General Coordination of Social Security Studies at SPREV/MTP. General Coordinator of Social Security Studies at SPREV/MTP Deputy Secretary of the General Social Security Regime at SPREV/MTP. Federal civil servant working at the General Coordination of Social Security Studies at SPREV/MTP.

Chapter 9

- Periodic Economic Benefits (BEPS): Promoting Individual Savings in a High Informality Environment President of Colpensiones Vice-president of Colpensiones

Chapter 10

- Incorporation of self-employed workers in the case of Chile: lessons of reform Deputy Executive Director, The World Bank. Former Head of Strategic Research at the Chilean Pension Regulator, and Vice President of IOPS

Chapter 11

- Expanding pension savings in Costa Rica Director of the Graduate School and Professor of the School of Economics at the University of Costa Rica. Former Superintendent of Pensions of Costa Rica.

Chapter 12

- The need for micropensions in Mexico Remuneration and Benefits Manager at Central Bank of Mexico

Chapter 13

- People with informal employment and pensions in Peru Former president of the Peruvian National Pension System Administrator (ONP)

Chapter 14

- Balance of regulatory and digital initiatives to promote pension financial inclusion in the Dominican Republic Pension Expert

Chapter 15

- Financial inclusion, digital payments and pension savings in Uruguay: a virtuous path Technical Secretary of the Social Security Experts Committee

Part Four

Chapter 16

- GanAhorro: a new way to save inclusively for retirement in Mexico * CEO of Pension Policy International Political and Economic Risk Consultant. Former member of Mexico Financial Stability Board and former Mexico’s pension regulator

Chapter 17

- Supplementing your retirement savings through consumption with Pensumo. Founding partner of LoRIS CEO of Pensumo

Chapter 18

- Pensions and informality: a view from Beway, the behavioral economics lab. CEO, Novaster

Chapter 19

- Longevity Income Pools: An innovative thoroughbred champion of retirement security Co-Founder and Chief of Global Strategy and Operations, Nuovalo CEO of Nuovalo Ltd.

Chapter 20

- Katapulta: a public sector pension innovation lab important in times of pandemic Leader of the Katapulta innovation lab

Chapter 21

- Millas Para el Retiro President & CEO, Millas Para el Retiro Executive at Vitalis Adviser- Vitalis

Chapter 22

- U-Zave: a Fintech with social impact that brings the world of savings closer through daily actions that contribute to improving people's financial health. Co Founder & CEO U-Zave. Co Founder & CFO U-Zave.

Chapter 23

- pinBox Director, pinBox Solutions Pte. Ltd. Director, pinBox Solutions Pte. Ltd.

Part Five

Chapter 24

- Why do informal workers not contribute to pension systems in Latin America and the Caribbean? Director for Latin America, Novaster CEO, Novaster and Professor of IE University Director of the Graduate School and Professor of the School of Economics at the University of Costa Rica. Former Superintendent of Pensions of Costa Rica Director, Novaster

Authors

David Tuesta

President of the Private Competitiveness Council - Perú

Long-standing international experience working with the financial sector, Latin American governments, and multilateral financial institutions. Chairman of the Private ...more

Laura Ripani

Chief, Labor Markets and Social Security Division at the Inter-American Development Bank

Laura Ripani is Chief of the Labor Markets and Social Security Division of the Inter-American Development Bank (IDB). She specializes in the area of labor markets ...more

Ekaterina Cuellar

Consultant at the Labor Markets and Social Security Division

Consultant at the IDB Labor Markets Division. Prior to joining the IDB, she worked as Head of Economic Research at ANIF, a renowned Colombian think tank. She also served ...more

David Kaplan

Lead Labor Market Specialist at Inter-American Development Bank

Lead Labor Markets Specialist in the Labor Markets and Social Security Division of the Inter-American Development Bank (IDB). He is also a researcher at the Institute for ...more

Waldo Tapia

Lead Specialist of the Labor Markets and Social Security Division at Inter-American Development Bank at IDB

Lead Specialist at the Labor Markets Division of the IDB. Since joining the IDB in 2008, he has been responsible for preparing and supervising social security projects and...more

Gustavo Demarco

Lead Economist at The World Bank

Pensions global lead at the World Bank. As a lead economist, he has led the World Bank’s operations and policy dialogue on pensions, social protection and labor across the Middle ...more

Fernando Larraín

Senior Consulting, World Bank

Fernando Larraín is a Senior Consultant at the World Bank. He is also a member of the Board of the International Centre for Pension Administration and advisor to the Board of the ...more

Sebastian Nieto

Head of Latin America and the Caribbean Unit at the OECD Development Centre

Sebastián Nieto-Parra is Head of Latin America and the Caribbean Unit at the OECD Development Centre at OECD. He also teaches economic policy of emerging markets at Sciences Po, Paris. ...more

Diana Mejia

Senior Specialist, Financial Inclusion, CAF

Senior Specialist in Financial Inclusion and Education at CAF – Development Bank of Latin America. Before this, she worked for the Central Bank of Colombia as Director of Economic and Financial. ...more

Noelia Bernal

Professor, Universidad del Pacifico

Professor of the Economics Department of the Universidad del Pacífico. She has a Ph.D. in Economics and a Master in Economics and Financing of Aging, both from Tilburg University, and a B.A. ...more

Fabrizio Solf

Research Assitant, Universidad del Pacifico

Research assistant and economics student at Universidad del Pacífico. Experienced in research on improving coverage and savings in pension systems using experiments and learning from behavioral ...more

Rafael Rofman

Independent Researcher

Researcher with recognized experience in pension and social security issues. He was Director of the Social Protection Program at CIPPEC, a renowned independent think tank in Argentina. He worked at the...more

Mauricio Leister

General Coordinator of Technical Studies and Conjunctural Analysis at the Subsecretariat of Complementary Social Security

Auditor of Finance and Control of the National Treasury in exercise at the Social Security Secretariat in the position of General Coordinator of Technical...more

Andrea Velasco Rufato

Federal civil servant - General Coordination of Social Security Studies at SPREV/MTP.

Federal civil servant in the career of Specialist in Public Policy and Government Management, works as coordinator of social security research and studies at the General Coordination of Social Security Studies of ...more

Otávio José Guerci Sidone

General Coordinator of Social Security Studies at SPREV/MTP

Federal civil servant in the career of Finance Auditor for the National Treasury. He works as General Coordinator of Social Security Studies at the Under Secretary of the General Social Security System/Ministry of ...more

Rogério Nagamine Costanzi

Deputy Secretary of the General Social Security Regime at SPREV/MTP.

He holds a doctorate in Economics from the Universidad Autónoma de Madrid and a master's degree in Economics from USP and in Management and Direction of Social Security Systems from the Universidad de Alcalá. He serves ...more

Eduardo da Silva Pereira

Federal civil servant working at the General Coordination of Social Security Studies at SPREV/MTP.

Federal civil servant in the career of Specialist in Public Policy and Government Management, works as coordinator of social security policies and economic analysis at the ...more

Juan Miguel Villa Lora

Former President of Colpensiones

Economist and Master in Economics from Pontificia Universidad Javeriana. PhD in Development Policy and Management from the University of Manchester. For more than 6 years he worked as a specialist in social protection ...more

Any Benitez

Vice-president of Colpensiones

Agro-industrial engineer from Universidad del Cauca and specialist in Government, Management and Public Affairs from Universidad Externado de Colombia, with 20 years of experience in financial inclusion, social...more

Olga Fuentes

Deputy Executive Director, The World Bank. Former Head of Strategic Research at the Chilean Pension Regulator, and Vice President of IOPS

Pension and labor expert with extensive experience in the global research, regulation and supervision ...more

Carmen Hoyo

Remuneration and Benefits Manager at Central Bank of Mexico

Head of Pensions and Remunerations at Banco de México. From 2011 to 2015 she worked for BBVA Research as Senior Economist in Financial Inclusion and Pensions. She also worked ...more

Victorhugo Montoya Chávez

Former president of the Peruvian National Pension System Administrator (ONP)

Creative and transformational leader. Lawyer, master in good governance. +15 years of experience in the public sector, in entities of constitutional justice, economy and public finance and social security. The last 3 years ...more

Diana Gratereaux

Pension Expert

Expert in pension matters, Operational Risk Management and Strategic Planning. She has worked for more than 12 years in the Dominican Pension System, as a consultant and in its supervisory body. He is currently Head of Risk ...more

Ariel Cancio

Technical Secretary of the Social Security Experts Committee

Ariel Cancio is Technical Secretary of the Commission of Experts on Social Security, which is responsible for carrying out a diagnosis and formulating recommendations that constitute the fundamental input for ...more

Victor Baeza

CEO of Pension Policy International

He worked for more than 20 years in the Regulatory Agency of the Pension System in Mexico, where as Vice President of Operations he led the implementation of innovative and disruptive models based on technological tools, promoting ...more

Carlos Ramirez

Political and Economic Risk Consultant. Former member of Mexico Financial Stability Board and former Mexico’s pension regulator

Mexico’s pension regulator 2013-2018. Economist and political scientist, former member of Mexico´s Financial Stability Board with expertise in political risk, financial markets and pensions. ...more

Jose Antonio Herce

Founding partner of LoRIS

José Antonio Herce is one of the leading experts on longevity and pensions in Spanish-speaking countries. With more than thirty years of teaching experience as a professor of Economics at the Complutense University of Madrid ...more

José Luis Oros

CEO of Pensumo

José Luis Orós is a social entrepreneur and CEO of the startup Pensumo. He started working at El Corte Inglés until 2013 when he founded Pensumo, an innovative platform that offers a savings model by measuring personal consumption and ...more

Manuel Garcia-Huitron

Co-Founder and Chief of Global Strategy and Operations, Nuovalo

Manuel is a Mexican economist specializing in the economics and finance of aging. He is passionate about translating best practices and research into viable innovative products. He has been involved in operational ...more

Richard Fullmer

CEO of Nuovalo Ltd

Richard K. Fullmer, CFA is CEO and co-founder of Nuovalo Ltd., a global PensionTech company that specializes in fair longevity risk pooling. He is also founder of Nuova Longevità Research, a pension research and consultancy firm located in ...more

Milena Caycho

Leader of the Katapulta innovation lab

Currently leading the first public sector innovation lab: Katapulta, through the experimentation of people-centered solutions. This covers from the design of the lab, the innovation strategy, the construction of prototypes and what I consider ...more

Jorge Lopez

President & CEO, Millas Para el Retiro

President and CEO of Millas para el Retiro ®; Founding partner and Director of Vitalis ® pension experts, various board positions in public and private companies. Independent board member of the investment committee of INFONAVIT ...more

Abraham Ernesto Hernández Pacheco

Executive at Vitalis

President and co-founder of VITALIS®, a Mexican company with international operations that provides consulting and investment services for private pension plans. He serves on the board of public companies ...more

Fernando Galindo

Adviser- Vitalis

Fernando Galindo is an adviser of Vitalis investment management for ESG and communications, and member of its investment committee. He is Professor of Business Ethics, Corporate Governance and CRS at the Universidad Anahuac and at the ...more

Michelle Hasson Kalkstein

Co Founder and CEO U-Zave.

Michelle Hasson Bachelor of Economics and Administration de la Pontificia Universidad Católica de Chile, Co Founder & CEO U-Zave Fintech de Ahorro, líderes de programas de micro ahorro en Chile. U-Zave ha recibido importantes ...more

Braulio Meneses Frías

Co Founder & CFO U-Zave.

Bachelor of Economics and Finance de la Pontificia Universidad Católica de Chile. CoFounder & CFO de U-Zave. Antes de fundar U-Zave, se especializó en el área de gestión de inversiones, participando de la administración de...more

Gautam Bhardwaj

Director, pinBox Solutions Pte. Ltd.

An Ashoka Fellow and promoter-director of pinBox Solutions, a Singapore-based global social enterprise focused on digital pension inclusion in developing countries. He has over two decades of experience working extensively with governments ...more

Parul Seth Khanna

Director, pinBox Solutions Pte. Ltd.

Co-founder and director of pinBox Solutions, a Singapore-based fintech enterprise committed to supporting digital pension inclusion in developing countries. She also runs the microPension Foundation, an India-based non-profit R&D hub. Over ...more

Carolina Felix

Director for Latin America, Novaster

Carolina Cabrita Felix is Director for Latin America and the Caribbean at the pension and longevity economics consultancy Novaster. Prior to joining Novaster, Carolina coordinated the Pension Network in Latin America and the Caribbean ...more

Diego Valero

CEO, Novaster and Professor of IE University

Professor at the University of Barcelona and Professor at the London School of Economics in specialised programmes in pensions and behavioural economics. Teaches Behavioral Finance at IE-University and holds a PhD in Economics and Actuarial Science...more

Edgar Robles

Director of the Graduate School and Professor of the School of Economics at the University of Costa Rica. Former Superintendent of Pensions of Costa Rica.

An international researcher and consultant on pensions supervision and risk management of both Defined Contribution and Defined ...more

Manuel Lozano

Director, Novaster.

Manuel Lozano is Director of Novaster. Economist and Actuary from the University of Barcelona. He has more than 20 years' experience in consultancy, where he has advised on all aspects of Social Welfare, focusing ...more